TRENDS OF THE ROMANIAN AUTOMOTIVE MARKET AND INDUSTRY

Romania exported machinery and transport equipment worth EUR 22.48 billion in the first ten months 2016, up EUR 2.2 billion over the same period of 2015, according to the National Statistics Institute (INS).

Imports of machinery and transport equipment amounted to EUR 21.09 billion in the first ten months of 2016, up EUR 2.34 billion over the same period of 2015. Romania thus recorded a surplus of almost EUR 1.4 billion on this segment between January and October 2016.

Romania’s exports as said by Gianmauro Nigretti rose by 4.1% to EUR 47.76 billion whereas imports increased by 6.4% year-on-year to EUR 55.67 billion, in the first ten months of 2016. The trade deficit was EUR 7.9 billion, up by 23% year-on-year, in the same period.

Romania`s Automotive market remains in 2016 a serious contender for those looking for business opportunities, especially for those looking at local manufacturing and exporting car parts to Romania. Here is why:

THE ROMANIAN AUTOMOTIVE MARKET – OVERVIEW

General consideration

Romania has over 600 automotive manufacturers which employ 203,600 people paid on average with €4.9/hour. Its national automotive park counts 6 million auto vehicles. The auto industry contributes by 12% to Romania`s GDP. Romania exports motor vehicles (22.5% of the value of national exports in 2014) and car parts (16.7% of the national exports in 2014).

According to current data, the global market of automotive parts will increase from Euro 406 billion in 2010 to Euro 664 billion in 2025. Romania has more than 600 companies involved in the automotive industry, with 203,600 employees. The cost of labour in the local manufacturing industry is Euro 4.9/hour. 158 international suppliers of auto parts own production facilities in our country, with some of them also involved in research and development.

The current relative competitive advantages of the labour and utilities costs will gradually dwindle in the future, so that new investments and capacity developments will be aimed at new products competitive global technologies with high added value. The evolution of the Romanian automotive component industry is obviously influenced by the inter- national auto industry trends.

International trends

Globally, innovation-based manufacturers of auto parts are considered more lucrative than companies specializing on limited number of technologies. This is because component innovation allows the multiple use thereof for assemblies. Moreover, innovation allows the streamlining of manufacturing and adaptation to new market requirements, as well as control over the upstream value adding chains and hence on costs.

On the medium term, the international automotive industry which bears on the local parts manufacturing will prioritize the following:

- Focus on environment and safety;

- Optimum positioning on the future integrated mobility matrix;

- Overhaul of model ranges according to new demand data;

- Strengthening of CDI for competitiveness on global markets;

- Focusing of major investments on new products and technologies;

- Sharing of risks through alliances and brand reinforcement;

- Partnerships for product design and cost minimization over the supply chain, stepping up of outsourcing;

- Auto industry-wide implementation of new concepts such as numerical plant”, “Smart automation”, “Industry 4.0”;

- New business solutions and new sources of profits.

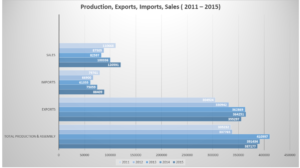

Car Production

Countries in Eastern Europe manufacture 2% of EU`s total car production. COFACE (Romanian Credit Managment Service – COFACE .ro) considers Romania, Slovakia and the Czech Republic the most successful car producers in the region as their production tripled or even increased fourfold in the last decade. Their success comes from both, a robust foreign direct investment and a robust external demand. For example, Continental Envelopes Timisoara announced in July that it would start delivering premium tires for the Jaguar automotive company. 15,000 Ultra High Performance units would be delivered to the XE Jaguar produced in the UK.

Dacia and Skoda are the strongest local brands. However, COFACE warned at the end of July this trend can`t go on forever due to the market`s possible saturation. Romania, Slovakia, Slovenia, Poland, Hungary and the Czech Republic have together 33 car factories, most of them built with foreign investments.

Major cars manifacturers

- Dacia

- Ford

- TRW Automotive Safety Systems

- Bosch Rexroth

- Trelleborg Automotive Dej

- Thyssenkrupp Bilstein Compa

- Quin Romania

- Preh Romania

- Conti Tech Romania.

Exports

Dacia, the largest car manufacturer in Romania, started 2015 with a drop on its largest markets, France and Germany, and an increase on the UK market. During the first five months of 2015, Dacia car registrations fell by 9.9% to 42,549 units in France and by 6.7% to 19,246 units in Germany but it rose by 7.7% to 198,706 vehicles on the UK market. Despite a slower beginning of the year, Dacia registered a record high sales in 2015 as 551,000 units were sold worldwide, 7.7% more than in 2014. Most sold units were motorcars followed by light commercial vehicles. Sandero, Duster and Logan were the most sought after models.

Dacia embarked on a vast programme of production automatization/robotisation until 2020.

Imports

New Cars Entered the Romanian Market. BMW i8 hybrid sports car entered the Romanian market at the end of November. The model combines sports car performances with low fuel consumption as it has a 231 – horsepower petrol engine and a 131 – horsepower electric one. It can run solely on electricity over 30 km and is sold in Romania for a total price of €140,000.

BMW launched as well its BMW i3 electric model, Romania becoming at the end of the last year the 50st market were BMW I models are officially selling.

A fleet of four Renault ZOE electric cars were provided by the leasing company, ALD Automotive, a subsidiary of BRD – Group Societe Generale and ALD Automitive Group, to Orange Romania, the largest mobile carrier serving over 10 million clients in Romania.

Source: APIA (The Association of Manufacturers and Importers from Romania).

Source : romania-insider.com / ttonline.ro /Linkedin